Lucid is committed to making share ownership available to as many of our employees as we can, through our Employee Stock Purchase Plan. Our ESPP offers employees the opportunity to purchase shares of Lucid (LCID) stock through convenient payroll deductions at a discount, allowing employees to share in the company’s success.

You may join during the next enrollment period following your start date with Lucid (please see further information below).

Please note: Eligible employees must have started 30 days prior to the ESPP offering date.

The ESPP is a simple and convenient way to purchase Lucid shares, enabling eligible employees (IRC 423 prohibits contractors from participating in this plan) to:

Important Dates for our ESPP Enrollments (example below)

If you are hired prior to the hire date cut offs listed above and are considered an “eligible” employee as stated above, you will be eligible to enroll during an open enrollment period. To enroll:

There are two 6-month purchase periods per year. Shares are purchased on the last day of the purchase periods, either at the end of May or November.

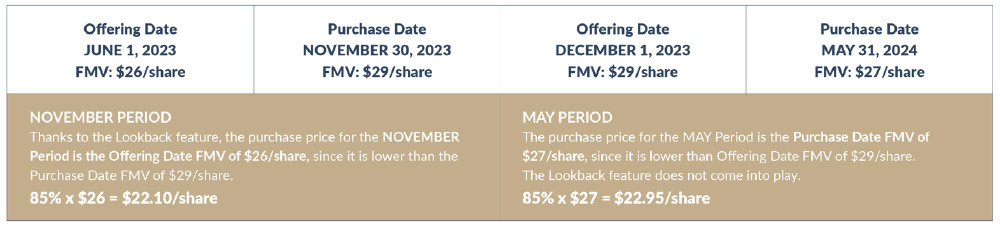

Lucid’s lookback and reset features ensure you are receiving the lowest purchase price at which you will purchase Lucid (LCID) shares.

If the share price is higher on purchase date than the price on the offering start date, the plan will “lookback” and purchase shares at the lower offering date price.

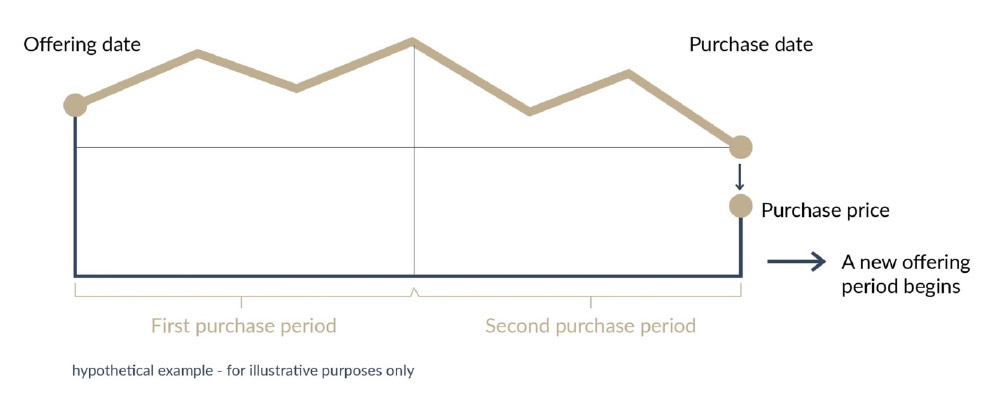

If the share price is lower on purchase date than the price on the offering start date, the plan will purchase shares using the lower price (purchase date). Additionally in this case, the plan will “reset,” and you will enter a new 2-year offering period using the lower price as the new offering start date price.

These features ensure you will always purchase shares at the lowest price—the price at the beginning of the 2-year offering period OR the price on the purchase date.

Please note: Only the prices on your offering start date and purchase date are taken into consideration for the price at which you will purchase shares.

The lookback feature bases your purchase price on the Fair Market Value (FMV) of the shares on the either the purchase date or offering date, whichever is lower.

The reset feature is like a rewind button under which if the stock price is lower at the end of a purchase period than at the original offering date, then, your plan’s offering period will “reset” and a new offering period will begin with the stock price at the end of the purchase period replacing the original stock price for loopback purposes. No action is required by you!

Our ESPP for employees is generally the same globally except when it comes to taxes, as taxes differ by country. If you would like to see more detailed information around taxes on the ESPP, please follow the directions below:

To access the Employee Stock Purchase Plan presentations by country, please visit our ESPP presentations folder and locate your country of choice.

Should you have any questions about the ESPP, please reach out to our team via HR HelpDesk.